Mining and energy integration is solution to Cameroon’s energy woes

(Business in Cameroon) - In a report published at the end of the March 2015, citing other cases in Africa, the World Bank indicated that the strong energy demands of the mining sector could be the key to developing the electricity sector and also improve energy supply in Cameroon.

“The development of the relationship between mining and energy should yield substantial benefits for the nation, mining companies, the electricity provider and the now inactive Central Africal Energy Pool (CAPP). Mining companies will gain from the major energy projects and they will contribute to the initial financing of the requiredinvestments,” explains the Bretton Woods institution in its report.

The Cameroonian government seems to have been seduced by the idea for some time. With the idea that mining companies can help the development of hydroelectricity, it adopted an approach of involving mining companies and major electricity consumers in the formulation of the new electricity legislation passed in December 2011, for which the implementation remains subject to the publication of various application decrees.

According to reliable sources, the idea was to allow the electricity company (Eneo) to have additional production capacity without having to finance hydroelectric projects and transportation lines. These investments are to be made by large consumers themselves as is the case with the construction of the Natchigal plant led by Rio Tinto (parent company of Alucam which recently announced its separation from the aluminium producer), the IFC and the EDF.

The Alucam case

As coherent as it may seem, the idea to rest energy solution in the hands of the mining sector is not necessarily that simple. It needs a clear legal framework which, itself, poses many problems. On the other hand, the idea came about at a time when the mining industry was booming.

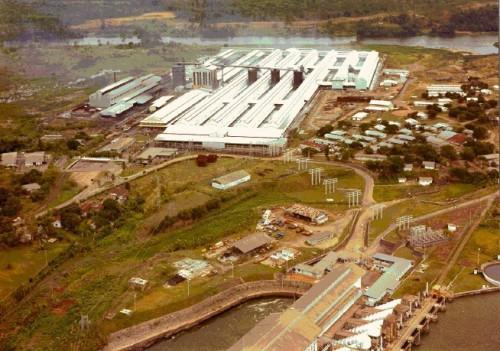

With the fall in the price of various commodities, investors are becoming increasingly wary of investing liquidity in a sector where prices are freefalling and profitability is uncertain. Reliable sources suggest that this is one of the current obstacles to the sale of Rio Tinto’s stake in Alucam (photo) as very few strategic partners want to take on investing in the energy facility (Natchigal plant) in a context of lower aluminium prices.

Furthermore, energy and mining integration could also be problematic in terms of hydraulic basin management. Indeed, according to experts, Alucam is no success story. The aluminium producer, which consumes more than half of the electricity produced in Cameroon, only provides 600 direct jobs and has contributed less than 2.5% to GDP in the last ten years. In addition, the potential impact this could have on the environment via the pressure placed on the Sanaga River has not been fully evaluated, state local pro-environment NGOs.

Mags frontpage

- Most read 7 days

- shared 1 month

- read 1 month