Loic Mpanjo Essembe : “Our stock market makes sure to generate no extra cost, for the exporter or the seller”

(Business in Cameroon) - The founder of the Mel Commodities Exchange which eyes Cameroon’s cocoa and coffee sectors, explains here how his platform works, and mentions challenges to the implementation of a commodities stock exchange in Cameroon.

Business in Cameroon: Last April 15th, you met in Douala, Cameroon’s economic capital city, with local importers and exporters and invited them to join your Mel Commodities Exchange (MELX), which is based in Cote d’Ivoire. What is it all about concretely?

Loic Mpanjo Essembe : First, I would like to thank Business in Cameroon and the Ecofin Agency for the quality of their work, their pertinent and specific content that provides a rational approach to the country’s risk amid global economic turmoil.

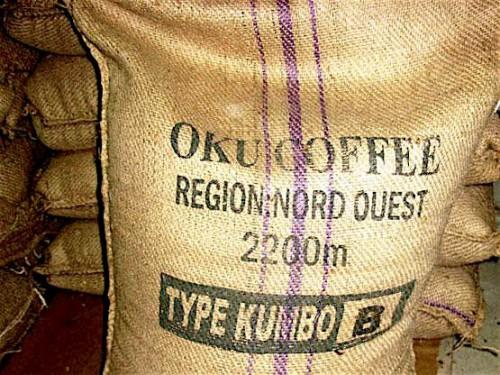

So, we decided to start promoting our stock market in Cameroon, namely by offering export contracts. Our choice was driven by a simple fact: Cameroon is a cocoa-coffee producer with a significant growth potential and challenges to export which are most representative of other markets. We are a structured commodities stock market with many indexes that allow us to provide import and export commodities contracts that are more competitive and profitable than those offered by other world-known reference markets.

We targeted commodities which are already being exported and which are more profitable for sellers than producers, without altering the value chain or prices for the final buyer. Our offer thus brings the market closer to the product and provides a safe and optimized transaction environment for both the seller and the buyer. This is similar to what does a market manager, an intermediary platform and a commodities exchange. Once one is able to conform to our protocol, he significantly boosts his value but also that of the buyer interested in his stock.

BC : How did economic operators respond to your offer and what are the concrete returns from the Douala meeting so far

LME : Most exporters and importers that we have met were charmed by our offer, which reduces the market to a simple contract backed by a safety net involving both parties. Regarding cocoa, exporters that we target - those that can hold a stored stock of commodities – are impatient to receive our rates and most of them understand our safety protocol

There are also those who have no interest in joining a stock market and who, obviously, will not join us. However, the initiative is in progress as most have noticed. In a commodity value chain, a singularity such as sub-traders cannot exist for long. Either it becomes a trader or it will vanish. Creating value in our system means establishing optimized and transparent sales and purchase conditions at each stage of the value chain.

BC: How could the commodity importer or exporter profit by conducting his business through the MELX ?

LME : For an exporter, there is always a variety of choices : either you sell directly to a firm which is one of your customers at conditions set based on negotiations regardless or not of the market; or you sell in a structured market, where price elasticity based on supply and demand is permanent.

For those who will benefit from joining the market, there is no need to tell them about the advantages of this market. It is one of the oldest institutions in the world. So why shouldn’t the tomato-seller for example open his own shop, but rather subscribe a placement in a market? It all depends on his business model. The real concern however is to know if there is a market which is accessible to this trader. That done, it comes to the trader to make the choice that suits him most.

We aim to create supply and demand concentration conditions in our reference system and let exporters know. Depending on rates, they will personally choose the best platform to achieve their performances. All we do is pick pertinent indexes, create supply and demand concentration conditions, and make all transactions and related deliveries safe for the parties involved. We also structure or help structure actors with a potential for export, such as cooperatives, so they can join the market if they so will.

BC : You claimed to be interested in Cameroon’s cocoa and coffee. Why only these two products?

LME : Our feasibility study led us to choose among products exported in Africa, those that can be traded in a market. Here, buyers and sellers can meet on the same platform and generate fluctuations which will help optimize or not participants’ margins. Being based in Cote d’Ivoire, it was only natural for us to think of the close to three millions tons shared by Cote d’Ivoire, Ghana and Cameroon and of coffee also, almost a million tons, amid global rising demand.

BC : Is there any other product in Cameroon that could be traded on your platform ?

LME : For our export contracts, we eye wood an cashew. For import, we already have rice and palm oil on two highly competitive indexes. However, we must also learn how to develop this market and develop a system with characteristics that correspond to our sub-regions.

BC : Since you said you will not develop a fully-fledged commodities exchange in Cameroon, how do you intend to operate in the country?

LME : Markets are subject to specific scientific rules which can be hardly evaded. When creating a retail market, you look for an accessible zone of residences. When creating a wholesale market, you look for an isolated zone of warehouses, close to a border and with an excellent service potential to serve wholesalers.

A stock exchange however is a mere Carrefour where buyers and sellers meet. It can thus be implemented either with the biggest buyer, or the biggest seller. Any other setting would be extremely fragile. In the case where your cocoa is traded in Douala and Abidjan also trades its’, supply in Abidjan will be greater than in Douala, so Cameroonians might finally sell at Abidjan’s prices. This would decrease the value of Douala’s market, and reduce it to a mere extension of the Abidjan market.

It is nothing special. This is why we wanted to list all three most sought after African cocoa markets in the same reference system. Obviously, there has to be one in Abidjan also. Thus, exporters will benefit from a common index, more pertinent in regard to demand. So, we directly contact exporters and structured cooperatives and provide them our rates while explaining our protocol.

BC : In September 2014, Eleni LLC which created the Ethiopia commodities stock exchange carried out, for Cameroon’s government, a feasibility study for the establishment of the Cameroon Commodities Exchange (CCX). Based on your experience in Cote d’Ivoire and on the success recorded by the Ethiopia Commodities Exchange, what do you think are the opportunities that such a project holds in Cameroon?

LME : Let me reassure you that developing a stock market is always positive both for a country and a region. I think Cameroon has a lot to gain in controlling its internal demand and exports as they constitute a significant share of the gross domestic product (GDP). However, it would be a mistake to think that supply is more important than demand. Both must remain in balance for the market to be sustained. There is thus a need to standardize what needs to be and make exceptions or at least take them into consideration when doing so can boost the competitiveness of local products.

The problem is that the model of the Ethiopia stock market is in itself already an exception when it comes to markets as it resembles a modernized stabilization system where the market stores physical stock in a warehouse and sell it itself in the stead of the seller. I understand this practice as it answers the risk of non-delivery, but the market cannot act as the seller, buyer, warehouse operator, certifying body and banker even. Operations become heavy and much expensive; this in turn cuts exporters’ margins.

However, this is not an absolute truth. It could work perfectly. I remain convinced that the market manager must do his job and let other members of the market chain do theirs. The main role of a market is to serve as a bridge between sellers and buyers so they can make their transactions. When there is only one buyer for many sellers or vice-versa, it is a shop not a market. Once again, let me recall that it is not an absolute truth.

According to you, what could be the barriers to the implementation of such a project in Cameroon ?

You are asking me to be the censor of a project for which I am neither the recipient nor the censor. You must look into its feasibility study which should give you information about some of its limitations. My opinion might not be very objective given my position and culture. However, if such a project is implemented, it could increase the value of our system as our stock market makes sure to generate no extra cost, for the exporter or the seller.

How can this type of project lead to agricultural development in the country?

If you improve, considerably, agricultural exports, you develop niches and producers will obviously expand their operating zones to create more value. In short, you increase wealth considering that increasing production will increase exports which will in turn increase the country’s gross domestic product. Of course, prices must be profitable both for producers and exporters.

Interview by Brice R. Mbodiam

Mags frontpage

- Most read 7 days

- shared 1 month

- read 1 month