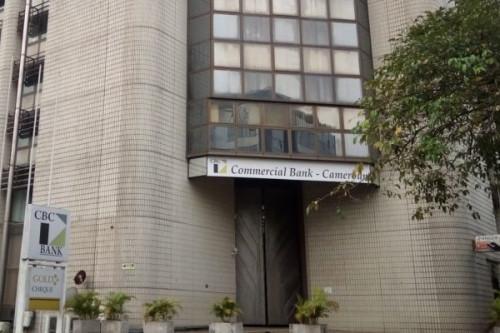

Commercial Bank-Cameroon: Government will sell most of its shares to a strategic partner and retail investors, DG Léandre Djummo says

(Business in Cameroon) - The government of Cameroon will sell most of its 98% shares in Commercial Bank-Cameroon (CBC), a release signed on May 4, 2021, by the bank’s Director General Léandre Djummo informs.

According to the release, most of the shares will be sold to a strategic partner selected via a call for expression of interest. Another portion will be sold to national retail investors on the regional exchange while the government will keep the remaining shares.

Currently, the schedule of the operations is not available yet but Léandre Djummo indicates that the schedule, as well as the measures taken in that regard, will be communicated in due course. He adds that the measures will be implemented in strict compliance with the OHADA Uniform act relating to Commercial Companies, and the banking regulations in force in the Central African subregion.

Another unknown fact is the exact volume of shares the government will sell to the strategic partner and retail investors. However, local media EcoMatin claims that the government has decided to keep 17% of the shares and sell 51% to the selected strategic partner and 30% to retail investors.

Commercial Bank of Cameroon (CBC) was founded in 1997 by the late business mogul Victor Fotso. After a long streak of successful years, the bank started experiencing difficulties because of its non-compliance with prudential ratios and the misappropriation of its capital. According to an audit carried out by COBAC, in 2009, the bank’s capital was close to zero while in May 2008, it was estimated at XAF11 billion. That year (in 2009), COBAC placed the bank (which was being managed by the founder’s son Yves Michel Fotso at the time) under provisional administration.

In 2016, the provisional administration was ended -after six extensions- when the bank was recapitalized, with the government of Cameroon investing XAF10 billion to acquire 98% of CBC. By March 2020, the former private bank’s equity capital was XAF23 billion, exceeding by nearly XAF8 billion the objectives set under the performance contract with the government.

Sylvain Andzongo

Mags frontpage

- Most read 7 days

- shared 1 month

- read 1 month