Towards a reform to boost SNI’s performance

(Business in Cameroon) - Authorised sources reveal that in 2011-2017, Société nationale d’investissement (SNI), which holds 15.20% shares in SABC, received CFA12.5 billion as dividends during the said period.

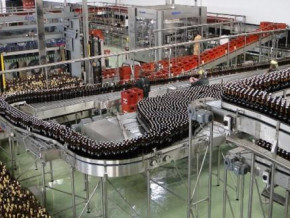

The lesser of these dividends was CFA287 million received in 2017 for the 2016 fiscal year. Between 2011-2014, the yearly minimum was CFA2.1 billion. Let’s remind that this evolution of the dividends reflects the evolution of SABC’s net results over the years. Indeed, officially, between 2011-2017, the company’s profits fell by 50% (from CFA45.2 billion in 2011 to CFA13.2 billion in 2016 before it rose to CFA21.9 billion in 2017).

Let’s also note that among the seven past fiscal years, 2016 was the least profitable. With only CFA287 million dividends for that year. SNI and the other shareholders of SABC were paying the price of taxes deemed unfavorable (between 45% and 64% during the period under review).

Not only were the taxes high, there was also the massive fraudulent imports from Nigeria and Equatorial Guinea as well as the crisis in the Far-North (with Boko Haram), in the East (with the political instability in Central Africa), and with the Anglophone crisis. All these factors affected SABC’s sales over the years. They also impacted the activities of many multinationals and private companies whose shares are owned by SNI. With most of the public companies in its portfolio being deemed unproductive, SNI’s revenues are decreasing, unlike its Moroccan peer which established large groups and is expanding in Africa. An example of such group is Attijariwaffa Bank that owns shares in Société commerciale de banque (SBC Cameroun).

To boost the performance of SNI which is its secular investment arm, in December 2016, Cameroon announced a reform for the creation of two investment funds within the institution.

According to the minister of industry Ernest Gbwaboubou, there is the Fonds national d’investissements stratégiques (Fonis), which will require an investment of CFA450 billion, and the Fonds d’appui au développement industriel (Fadi).

The minister explained that the Fonis would invest in large infrastructure projects launched by government and Fadi would be a venture capital section.

For the record, a venture capital company participates in vulnerable companies or those in difficulty and withdraws once that company reaches a certain equilibrium or is firm.

Brice R. Mbodiam

Mags frontpage

- Most read 7 days

- shared 1 month

- read 1 month