Cameroon: Taxpayers’ association ACDC denounces the "abusive" commissions collected by banks for tax operations

(Business in Cameroon) - In a letter sent on February 1, 2021, to Modeste Mopa Fatoing (Director general of taxes) and Louis Paul Motaze (Minister of Finance), the Cameroonian Association for the Defense of Taxpayers' Rights (ACDC) denounces what they call the "abusive" commissions levied by banks when taxpayers pay their taxes through them.

Indeed, in the 2021 finance law, taxpayers are prohibited from paying taxes in cash. They can only pay through bank transfers or using the authorized digital payment methods. However, according to the ACDC, when taxpayers pay via bank transfers, the banks collect between XAF1,000 and 2,350 as commissions.

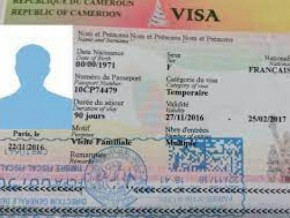

A taxpayer’s payment receipt we saw shows that a 13.75% commission was collected for the payment. Indeed, for the payment of a XAF14,960 tax, the payer paid XAF17,345 for the whole operation meaning XAF14,960 for the tax and XAF2,385 as a commission for the operation.

We are disputing "the enforceability of these fees," wrote Mazou Mouliom, president of the ACDC. For the president, taxpayers cannot pay commissions on those taxes since the taxes are compulsory deductions like social contributions. Therefore, their payment should be commission-free like it s for social contribution payments be them via bank transfers or via mobile payment solutions.

"Are those commissions taxes? What kind of taxes are they? In Cameroon, the taxes are gradually becoming confiscatory because the levies exceed taxpayers’ revenues. In this sensitive period when the health crisis has become a cash flow crisis, Cameroonian SMEs are not yet ready to indirectly finance financial institutions. Instead, they need financing," he added.

Let’s note that according to some banks, the commission levied is legal and was authorized by the Directorate General of Taxes (DGI).

Sylvain Andzongo

Mags frontpage

- Most read 7 days

- shared 1 month

- read 1 month