Approximately 98% subscription for Cameroon’s Eurobond, with an interest rate close to 10%

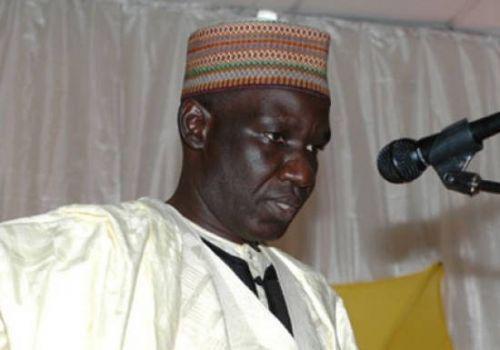

(Business in Cameroon) - For the first foray of Cameroon on the international capital market, the Minister of Finance, Alamine Ousmane Mey (photo), and his team, did not achieve a master stroke. This is at least what the specialised news website Global Capital indicates, revealing that the very first Eurobond of the State of Cameroon, which finally raised USD 1.2 billion (over FCfa 650 billion), only had a 98% subscription rate.

This subscription rate below 100%, far less attractive than the successful over-subscriptions sometimes reaching 500% by Eurobonds issued in the past 2 years by African countries, gives a good idea on the credibility of the Cameroon brand (country rated B/B- by Standard & Poor’s) on the international market.

Another indicator of the caution shown by investors is the interest rate of this Eurobond of a maturity of 10 years. In effect, we learned that the interest rate is close to 10%, standing at precisely 9.75%. This is one of the highest interest rates given to an African country in at least 2 years (though less than Ghana who got 10.75% this year), following the issuance of several Eurobonds. Upon further analysis, the rate could have been higher except for the partial guarantee offered by the African Development Bank (AfDB).

However, some credible pieces of information would lead to not attributing this interest rate to the limited confidence investors have in Cameroon. According to this information, the Cameroonian government was handed an interest rate of 9.75%, following the reticence of investors to accept a lower rate for only a USD 1.2 billion Eurobond. In other terms, with a higher demand, the interest rate could have been decreased.

The money raised by Cameroon through this Eurobond co-arranged by Société Générale and Standard Chartered Bank, will be used to finance the three-year emergency plan of the government (2015-2017), with a total amount of FCfa 925 billion.

BRM

Mags frontpage

- Most read 7 days

- shared 1 month

- read 1 month