Cameroon: CICC getting ready to launch Loan Guarantee Fund for cocoa farmers, with FCfa 400 million already

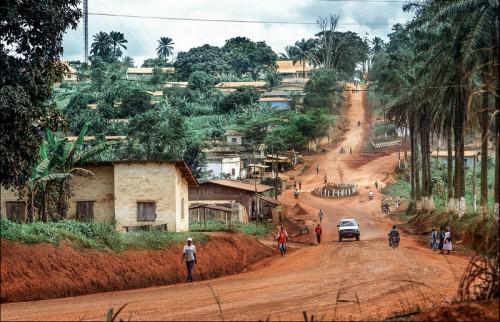

(Business in Cameroon) - The Inter-professional Cocoa and Coffee Council (CICC) organised on 28 and 29 September 2016 in Yokadouma, large production area in the Eastern region of Cameroon, an awareness workshop for cocoa producers on the importance and good recordkeeping of the producer book.

This is, we learned during the Yokadouma meetings, a document representing an identity card of the producer, as it contains information on the producer, the cooperative to which he is affiliated, the technical management and production volumes, its phytosanitary treatments or the areas covered by the farms.

At CICC, it is emphasised that the producer book will mainly be, we learned, the key element in the documentation to be provided to financial organisations, in order to obtain funding guaranteed by the Fund set up for this purpose by CICC. “Raising awareness within the producer population on the necessity of good recordkeeping with regards to their book is a crucial step in the operationalisation of our Guarantee Fund. This document, in addition to ascertaining the eligibility of a producer to access funding, will first and foremost determine the level of credit to be granted to a particular producer”, explains a senior official in the cocoa and coffee regulatory authority.

As a reminder, in order to reduce the difficulties in accessing funds experienced by cocoa and coffee producers in Cameroon, CICC set up a Guarantee Fund, to share the risk with the financial institutions who would grant said loans. Provisioned with FCfa 100 million every year, this Fund, whose operationalisation CICC is presently finalising, now totals FCfa 400 million, we officially learned.

Brice R. Mbodiam

Mags frontpage

- Most read 7 days

- shared 1 month

- read 1 month