Tax on money transfers: Cameroonian taxpayers’ association ACDC denounces a double taxation

(Business in Cameroon) - In its 2022 draft budget submitted for the parliament’s review, the Cameroonian government has introduced a new tax on electronic money transactions.

The tax is planned to be applied to transactions carried out through all the traceable technical platforms (like internet, mobile phone, wire order, telex, fax) except for bank transfers and electronic transactions carried out to pay tax and customs duties. The tax will also be applied to cash withdrawals from financial institutions or mobile telephony operators.

It represents 0.2% of the amount sent or withdrawn. According to the draft budget, it will be collected by financial companies and mobile telephony operators and transferred into the public treasury by the 25th of the month following its collection.

Critique by taxpayers

This project is met with consumer associations’ critics. On November 28, 2021, the Association of Cameroonian Taxpayers (ACDC) issued a release to “reject the double taxation introduced in the 2022 draft bill, which is planning the reaction of a tax on money transfers.”

“(...) The tax is levied when the funds are sent but also withdrawn. So, when you send XAF10, 000 to someone, you will incur a 0.2% tax. Also, when withdrawing the fund you were sent, you will also incur the 0.2% tax. This is another way to hinder the development of electric money and discourage electronic money transactions (...) Let’s suppose you first received a XA20,000 transfer. Later, you received another transfer f XAF40, 000 and an additional XAF50, 000. Which transaction will bear the tax if you have to withdraw XAF30, 000? Tax principles state that when an operation is already taxed, no additional tax should be applied. Money transfers are already subjected to the VAT and now this tax is introduced. We ask the parliament to reject this draft law. In the article [relating to the tax], there is no specification about when the transaction will be taxed because the ‘or’ in it is not exclusive” wrote Mazou Mouliom, chairman of the ACDC.

Government has yet to respond to taxpayers’ concerns

The government has not yet spoken about the ACDC’s concerns. However, authorized sources at the Ministry of Finance indicate that clarifications will come in the coming days. In addition, experts at the Ministry of Finance believe electronic money transfer is an important tax collection niche.

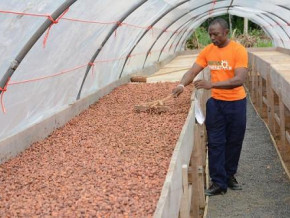

Orange Cameroon, which controls 70% of the Cameroonian mobile money market, has recorded cumulated monthly transactions estimated at XAF800 billion this year. Yearly then, the estimate will be XAF9, 600 billion, which is about twice the state’s 2021 budget.

Sylvain Andzongo

Mags frontpage

- Most read 7 days

- shared 1 month

- read 1 month