CEMAC: COSUMAF plans to introduce green, sustainable, and social bonds on the BVMAC

(Business in Cameroon) - On October 11, in Douala, the Central African Financial Market Oversight Commission (COSUMAF) expressed its ambition to introduce green, sustainable, and social bonds (GSS) on the Central African Stock Exchange (BVMAC). In that regard, the commission published a guide detailing the mechanism of those bonds.

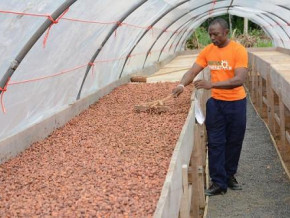

GSS are bonds issued for projects that address the environmental and social problems of Central African countries, explained Nagoum Yamassoum, COSUMAF chairman.

The sectors concerned by those bonds are renewable energy, pollution prevention, terrestrial and aquatic biodiversity conservation, green transport (electric or hybrid cars as well as projects related to sustainable management, and those benefiting vulnerable groups and the illiterate population.

It is worth mentioning that the interest rates on such bonds are usually lower than those offered for conventional bonds, even though GSS finances sustainable development and protects the planet against pollution and various disasters.

During the presentation of the GSS project, Dieudonné Evou Mekou, vice-governor of the Bank of Central African States (BEAC), wondered whether the CEMAC market was ready for such bonds given that only international investors are mostly interested in those issues. If the GSSs are issued in local currency, the challenge will be to encourage local investors to buy such bonds, he added.

"Governments can offer incentives to encourage local investors to buy GSS bonds. In Morocco, such bonds are mainly issued by institutional investors. There is a local market and perhaps with the promotion of green finance, people can become more interested in the CEMAC region,” replied a member of the Moroccan delegation that took part in the presentation.

As for Marcel Ondele, vice-president of the Development Bank of Central African States (BDEAC), he indicated that his institution was interested in such bonds and also issues green bonds for projects related to the conservation of the Congo Basin.

The COSUMAF GSS bond project is announced in a context marked by low stock culture in the CEMAC region. In that context, in October 2019, the management board of the Central African Stock Exchange (BVMAC) asked the Managing director to take every possible measure to stimulate the market by notably taking part in state companies’ asset disposals organized by members of the CEMAC zone (Cameroon, the Central African Republic, Congo, Gabon, Equatorial Guinea, and Chad). Also, during its videoconference of July 3, 2020, the Ministerial Committee of the Central African Monetary Union (UMAC) invited CEMAC countries that have not sent the list of state companies to be listed on the BVMAC to urgently do so.

Sylvain Andzongo

Mags frontpage

- Most read 7 days

- shared 1 month

- read 1 month