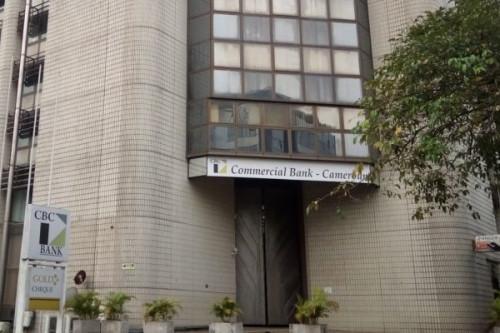

Cameroon: Saved from bankruptcy by the State, Commercial Bank-Cameroon is regaining its momentum

(Business in Cameroon) - On October 7, 2020, Cameroon’s public treasury successfully raised XAF35 billion on the CEMAC money market. 37.5% of the envelope (XAF13 billion) came from Commercial Bank-Cameroun (CBC) during this fundraising operation subscribed by all of the giant banking groups operating in Cameroon (BICEC, Société Générale, Ecobank, SCB Cameroun).

CBC (created by late businessman Victor Fotso before becoming a state-owned bank after a long and difficult restructuration process) thus confirms its solvency. This solvency and also the group’s renewed dynamism on the local banking market is also reflected in a report (on the change of borrowing rates in the CEMAC region) recently published by the central bank BEAC.

According to the report, CBC was among the top 4 banks that provided the most loans in Cameroon in H2-2019. During the period, the bank provided 14.4% of overall credits in the country, against 9.34% in H2-2018, representing a 5.1% year-over-year rise. Over the period, the volume of loans it granted in Cameroon even exceeded that of Afriland First Bank, the only Cameroonian bank (majority-owned by Cameroonians) that has for years been competing with multinationals operating in the local bank market.

Apart from being dynamic on the credit market, CBC also recorded impressive results in 2019. Indeed, its net profit that year was XAF2.5 billion (up from XAF1.5 billion in 2017). This performance exceeded the XAF2,110 billion target set by the 2018-2020 performance contract signed by the bank and the state of Cameroon, which is its leading shareholder.

Capital opening operation

The bank also exceeded (by about XAF8 billion) the XAF15.529 billion 2020 (XAF12.016 bln in 2017, XAF12.937 bln in 2018, and XAF14.097 billion in 2019) equity target set by the performance contract. Indeed, in March 2020, the CBC announced that its equity had already reached XAF23 billion.

With all these attractive indicators, the bank can prepare the opening of its capital to trustworthy investors, as the 2020 roadmap elaborated for it reveals.

Established in 1997, CBC enjoyed a long period of prosperity before challenges arose because of the non-compliance with prudential ratios and the misappropriation of the bank’s equity capital (which was near zero after culminating to over XAF11 billion in May 2008, according to an audit conducted by the Central African Banking Commission COBAC). The bank, which was then under the management of Yves Michel Fotso (son of the founder), was placed under provisional administration by COBAC in 2009.

After six extensions over 7 years, the provisional administration was ended in 2016 following the recapitalization of CBC. Indeed, in April 2014 (after two consecutive administrative board meetings ignored by the historical shareholders who were denouncing an "expropriation attempt"), CBC was recapitalized to the tune of XAF12 billion, of which XAF10 came from the State of Cameroon that now controls about 98% of the bank’s assets.

Brice R. Mbodiam

Mags frontpage

- Most read 7 days

- shared 1 month

- read 1 month