Cameroon still enjoys good rating on the BEAC stock market, Gabon, Chad and CAR less so

The public Treasury of Cameroon, the Central African Republic (CAR), Chad and Gabon were able to raise over FCfa 26 billion in a week (20 and 27 July 2016), on the public stock market of the Bank of Central African States (BEAC), we learned from the official communiqués of this issuing institution.

But, the results of selling sessions of the public bonds from these countries present the picture of an important gap on the level of confidence that investors have for each of these four States in the CEMAC zone.

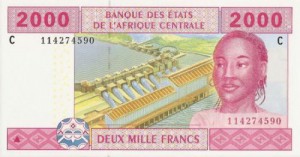

With a subscription rate of 235% (FCfa 16.5 billion were offered for a demand of only FCfa 7 billion) to its bonds with a maturity of 52 weeks, and an average interest rate of 2.4%; Cameroon always has a go signal on this market, where it has been the main actor since its creation in 2011.

Crowned with yet another success, the Cameroonian Treasury will attempt again on 3 August, to raise an additional FCfa 7 billion. This will be done through the issuance of Treasury Bills (BTA in French) with a maturity of 26 weeks this time around.

However, for Gabon, Chad and CAR, indications from the BEAC public stock market seem to point towards a slowdown. Indeed, out of the 3 to 5 billion requested by Gabon on 20 July, through the issuance of Fungible Treasury Bonds (OTA in French) with a maturity of 2 years, only FCfa 4 billion were raised, thus a subscription rate of 80%.

Additionally, investors only agreed to provide the funds to the Gabonese Treasury with an average interest rate of 4.5%. Which however did not deter this country severely affected by the drop in the oil revenues, as Gabon will again try to raise FCfa 6 billion on the BEAC market on 3 August, with the issuance of Treasury bills with a maturity of 13 weeks.

Chad, for its part, posted the smallest rate of subscription on the BEAC market last week. The Treasury of this country, also badly affected by the drop in international oil prices, was only able to raise FCfa 11.2 billion out of the FCfa 20 billion requested on 27 July, corresponding to a subscription rate of 56%. The average interest rate demanded by investors during this sale session of 13-weeks Chadian BTA, peaked at 3.9%.

From this point of view, Chad did better than the Central African Republic. This CEMAC country, which is picking up after a long political instability, had to agree to an average interest rate of 5%, to raise FCfa 4 billion on the BEAC market, through the issuance of 26-weeks BTA. This was on 20 July.

The 5th country on this market, Equatorial Guinea, is jumping in the fray to raise funds on 3 August 2016, to attempt to get FCfa 20 billion through the issuance of 52-weeks BTA.

No information has been released so far on the operation (to raise FCfa 10 billion) scheduled to take place on 20 July on this same market by the oil El Dorado of the CEMAC area, who is paying the high price for its extensive dependency on oil revenues.

Brice R. Mbodiam

Cameroon, Gabon and Equatorial Guinea looking for FCfa 20 to 22 billion on BEAC market on 20 July

With the recent decrease in oil revenues which represent between 20 and 80% of public revenues in the CEMAC area, the States in this economic community are now doing battle in the government securities market of the Central Bank (BEAC), in order to cover their cash management problems. For example, for the sole day of next Wednesday 20 July, three member states of CEMAC (Cameroon, Gabon and Equatorial Guinea) will try to mobilise a total envelope of between FCfa 20 and 22 billion, we learn from the Bank of Central African States (BEAC).

Cameroon, the main facilitator in this market since its launch in 2011, with 16 dealers in Treasury securities, that the country has authorised in this market, aims to raise FCfa 7 billion by means of an issuance of fungible treasury bonds with a 52-week term. Gabon, crowned by a subscription rate of 254% registered during its last issuance of Treasury bonds with the purpose of raising FCfa 5 billion last 13 July, will launch 12 dealerships in the battle, in order to try and collect between FCfa 3 and 5 billion.

The operation will be made by the issuance of OAT fungible Treasury bonds, with a 2 year maturity term, advises a communiqué from the BEAC.

On its side, Equatorial Guinea, the new oil Eldorado in the CEMAC area, which has ignored the securities market of the BEAC since its creation up until now, is also in the race next 20 July, to try to mobilise FCfa 10 billion by issuing BTA - fungible Treasury bonds - with a maturity of 52 weeks. 10 dealers in Treasury securities are in line to help the Equatorial Guinean Treasury to achieve this objective. With the arrival on the BEAC government securities market of these countries, which are now burdened with budget deficits since the trigger of the crisis around the international price for the barrel of oil, only Congo remains for the time being outside this market, that is more and more popular with countries in the CEMAC area.

According to statistics revealed after the first meeting in 2016 of the Supervisory Body of the Task Team (CRCT - Conseil de surveillance de la Cellule de règlement et de conservation des titres), held on 14 April 2016 in the headquarters of the Central Bank in Yaoundé, the issuance of government securities by States have doubled in 2015 compared to 2014.

These operations cumulated in FCfa 635.8 billion, at the end of February 2016, against FCfa 312.4 billion over the same period last year. "This sharp rise in States resorting to the securities market falls within an economic context marked by tightening of banking liquidity observed in the first semester of 2015, related to weakness in international oil prices for the majority of the economies in CEMAC", BEAC explained in the official communiqué.

Brice R. Mbodiam

The budget deficits of the CEMAC States doubled between June 2015 and June 2016

Between the 2nd quarter of 2015 and 2016, the budget deficit for all six member-States of the CEMAC (Cameroon, Congo, Gabon, CAR, Chad and Equatorial Guinea), increased, since it went from 3.5% to 7.9% of the community’s GDP; therefore doubling within the course of a year.

The Monetary Policy Committee (CPM) of the BEAC, the central bank of these States, moreover revealed on 12th July in Yaoundé, during its 2nd ordinary session for 2016, tha the deficit in the external current account also increased over the same period. However, at a lower rate, as it peaked at 14.8% of GDP as at end June 2016, against 14.4% the previous year.

At the roots of this deterioration of this public Treasury in the CEMAC area, CPM points out “the persistence of the effects of the drop in the world prices for oil”, with five countries out of six producing the commodity. As a reminder, oil revenues represent, officially, between 20 and 80% of the budgets of the countries in the CEMAC.

Moreover, explained the governor of the BEAC, Lucas Abaga Nchama, who was pleased with the adjustments made by the States to date, particularly the drop in investment expenditure in several countries; some structuring projects for which the public authorities have made commitments to their populations continue to engulf important amounts of public funding. All this, while the trend for new revenue collection is going downward.

Therefore, to cope with this situation, Lucas Abaga Nchama again invited the member-States of CEMAC to work toward the improvement of the business climate, the regional integration and above all, the diversification of their economies; to reduce their dependency on oil revenues and massive imports of manufactured products from the West.

Brice R. Mbodiam

In 2013-2015, the “Carte Rose” enabled CEMAC insurers to pay cross-border damages worth FCfa 382 million

The Council of “Carte rose” (Pink card) offices, a tool established by the member-States of the CEMAC (Cameroon, Congo, Central African Republic, Gabon, Chad and Equatorial Guinea) to facilitate payments of cross-border damages by insurance companies, reveals that the national offices received 232 claims over the 2013-2015 period.

These claims by policy holders, we learned at the end of an extraordinary meeting which just ended in Yaoundé, enabled the different “Carte rose” offices to facilitate payments worth a total of FCfa 382 million by insurance companies operating in the CEMAC area.

Established 20 years ago as part of the integration of risks to which policy holders are exposed (particularly drivers) in the CEMAC area, the “Carte rose”, as acknowledged by insurance experts, has not yet been fully adopted by drivers working in the transport across borders sector.

BRM

Cameroon seeks FCfa 7 billion on BEAC’s public stock market

The Cameroonian public Treasury will issue, on 8 June 2016 at the headquarters of the Central African States Bank (BEAC) in Yaoundé, government bonds (BTA), worth FCfa 7 billion, we learn in an official communiqué signed by the Managing Director of the Treasury, Sylvester Moh.

These debt securities with a maturity of 26 weeks, whose interests are exempt from withholding tax, can be bought until 8 June at 9am from the 16 banks in the CEMAC zone recruited by the Ministry of Finance, and acting as primary dealers (SVT) on behalf of the Cameroonian State.

By increasing the number of primary dealers from 13 to 16 since the beginning of this year, Cameroon is giving itself more room to successfully complete all its operations on the BEAC market in 2016, despite the competition from the Gabonese and Chadian Treasuries, two countries who have become very active on this public stock market consecutive to the drop in their oil revenues.

As a reminder, during the current second quarter 2016, the Cameroonian Treasury will try to raise a global sum of between FCfa 62 and 72 billion. This represents FCfa 42 billion to be raised through the issuance of BTA, and FCfa 20 to 30 billion through two issuances of fungible Treasury bonds (OTA) with a maturity of 2 to 3 years, for FCfa 10 to 15 billion per operation.

BRM

Lire aussi:

Cooperation: Congo wants to inspire Gabon in terms of youth access to labour market

On the fringes of the triennial regional roundtable consultations of the Association for the Development of Education in Africa (ADEA) organised in Gabon from 30th May, the Gabonese Prime Minister, Daniel Ona Ondo, received yesterday in Libreville the Congo-Brazzaville Minister of Youth and Civic Education, Destinée Hermella Doukaga.

The Congolese Minister came to get informed on the implementation by the Gabonese government of the programme “One Youth, One Job” launched a few months ago. This programme is meant to take care of young people facing significant social and professional difficulties with the objective of professionally integrating and reintegrating close to 2,500 young people in 2016. Today, this project is at the heart of a cooperation partnership between Gabon and Congo-Brazzaville. For the Congolese Minister, this multidimensional cooperation which dates back several years is a testimony of the determination of the Gabonese President, Ali Bongo Ondimba, and the Congolese President, Dénis Sassou Nguesso, to work towards the professional integration and reintegration of the African youth, future of the continent.

In the same vein, the Administrative Authority of the Special Regime Economic Zone (Zerp) of Nkok was visited, on the same day, by a Congolese delegation led by the Congolese Minister of Youth. An occasion for the administrator in charge, Sèdji Armel Mensah, to present to the Congolese visitors, the advantages of the Nkok Zerp and highlight the commitment of the companies who take part in the test phase of the “One Youth, One Job” programme.

Cemac wants to elaborate a single mining code for its member-States

The Cemac Commission launched this 11 May 2016 in Douala, the economic capital of Cameroon, a study for the elaboration of a single mining code enforceable in the six member-States of this community: Cameroon, Congo, Gabon, Equatorial Guinea, CAR and Chad.

This study carried out with the support of the raw materials capacity-building Project in Central Africa, financed by the German cooperation; is led by a regional group of experts specialised in mining law, in association with experts from the member-States of the Cemac.

According to the Cemac Commission, the study initiated on 11 May 2016 “will help propose, based on the mining laws already in force in the Cemac, a communal mining code project adapted to the challenges of the sub-region and the international standards in terms of transparency, environment protection …”. The final results of this study are expected at the end of this year.

BRM

Cameroon: Fcfa 90 billion to maintain over 16,000 km of roads in 2016

The Cameroonian Ministry of Public Works has just officially launched the 2016 road maintenance campaign. According to the senior officers of this ministry, this year, a budget of FCfa 90 billion has been allocated to the road maintenance works in the country.

Thanks to this funding, of which about half (FCfa 42 billion) comes from unused resources carried over from 2014 and 2015, the Cameroonian government plans to maintain over 16,000 km of roads throughout the country this year, we officially learned.

As a reminder, less than 10% the Cameroonian road network is maintained, due to insufficient resources allocated to the works, Jean Claude Atanga Bikoé, Administrator of the Road Fund, recently confided. Indeed, we learned, the main source of resources for these works come from part of the special tax on oil products paid by oil products distributors. This licence fee is currently, the Road Fund Administrator said, of FCfa 55 billion per year, while the maintenance cost of a single kilometre of unpaved road, with the network estimated to have 100,000 km (excluding tarred roads), is on average of FCfa 2 billion.

Brice R. Mbodiam

Issuance of bonds in the CEMAC zone doubled in 2015, to FCfa 635.8 billion

With the sluggish economic environment strongly impacting in the economies of the Economic and Monetary Community of Central Africa (Cameroon, Congo, Gabon, Equatorial Guinea, Chad and Central African Republic), the public stock market of the common Central Bank of the six above-mentioned countries has become more dynamic. According to statistics revealed at the end of the first meeting in 2016 of the Monitoring Committee of the Regulation and Conservation Unit (CRCT), which took place on 14 April 2016 at the headquarters of the Central African States Bank (BEAC) in Yaoundé, the issuance of bonds by the States doubled in 2015 compared to 2014.

These operations by the Treasuries of the CEMAC member States peaked at FCfa 635.8 billion as at February 2016, against FCfa 312.4 billion for the same period last year. "This sharp increase in the States resorting to the public stock market fits within an economic context characterised by the tightening of banking liquidity observed since the first half of 2015, in relation with the weak international oil prices in most of the CEMAC economies", the BEAC explains in an official communiqué.

Indeed, faced with the drop in world prices for oil, which reduced by 20% (Cameroon) to more than 70% (Equatorial Guinea) the budgets of the CEMAC countries, the States scaled up their operations on the public stock market of the Central Bank, in order to raise the resources necessary to finance the budget deficit. Thus, Cameroon, main player on this market since its creation in 2011, had announced, from January 2015, issuance of bonds to the tune of FCfa 375 billion, against FCfa 160 billion for Chad and FCfa 135 billion for Gabon.

2015 on the public stock market of the BEAC was also characterised by the entry of a new country on the market, being Equatorial Guinea, whose oil revenues represent 85% of the national budget. The introduction of this African oil kingdom thus brought to five the number of CEMAC countries operating on the public stock market of the central bank. To date, the only operation expected remains that of the Republic of Congo.

In this economic situation, the public stocks operations on the BEAC market should again grow in volume in 2016. Indeed, according to the provisional schedules of operations, as communicated by the States to the central bank, according to regulations, the two main players of the market, Cameroon and Gabon, are planning to issue bonds respectively worth FCfa 370 and 195 billion. Thus a total envelope of FCfa 565 billion.

BRM

BDEAC had a net profit of about FCfa 2 billion in 2015, in increase of 63%

The Central African States Development Bank (BDEAC in French) closed 2015 with a net profit of slightly over FCfa 1.9 billion, we officially learned. The profit thus made shows an increase of 6.3% compared to 2014, our sources highlighted.

Disbursements for projects to be financed in the CEMAC community have also increased by 26.7% compared to 2014, at about FCfa55.2 billion as at 31 December 2015.

These releases of funds to enable the financing of development projects should again rise in 2016, thanks to the financial contribution made to BDEAC by the issuing institution of the six countries of the CEMAC area, the Central African States Bank (BEAC).

Indeed, the Governor of the BEAC, Lucas Abaga Nchama, and the President of BDEAC, Abbas Mahamat Toli (photo), signed on 19 January 2015 in Yaoundé, the Cameroonian capital, a set of “acts on the support of the BEAC to the BDEAC, for the funding of development project” within the CEMAC zone, for a total amount of FCfa 400 billion.

“This is the first time that the community’s issuing institution (which increased its shareholding in the capital of BDEAC from 6 to 33%, Ed.) is seriously committing itself to the refinancing of development projects in the member States”, who moreover specified that the establishment of these financial tools “will enable the BDEAC to fill the important gap observed between the resources and commitments of the BDEAC, but also to have additional substantial resources for the financing of new projects and programs”.

BRM

Mags frontpage

- Most read 7 days

- shared 1 month

- read 1 month