Cameroon : Tax revenues affected by low VAT collection in Jan-Sep 2019 (Ministry of Finance)

(Business in Cameroon) - With a total of XAF1,324.3 billion collected between January and September 2019, Cameroon’s tax revenues fell by XAF29.4 billion (-2.2%) year-on-year. “Compared to the XAF1,485.3 billion target for the period, tax revenues is down by XAF161 billion, representing an achievement rate of 89.2%,” the Ministry of Finance indicated in its report on the execution of the state budget at the end of September 2019.

According to the ministry, this drop in performance is due to a decrease in the Value Added Tax (VAT), the main tax in the tax base, during the period under review. “This decline is mainly due to the VAT, which is down by XAF68.2 billion,” and whose collection rate at the end of September was only 74.1% officially.

The decrease in the volume of VAT collected, which can be explained by a slowdown in household and business consumption, could have had a greater impact on overall revenue if the collection of other taxes had not been higher.

Indeed, the drop was mitigated by increases in Personal Income Tax (+ XAF25 billion), excise duties (+ XAF8.1 billion) and registration and stamp duties (+ XAF4.1 billion).

Although high year over year, all these taxes did not reach the collection target level for the period because the Ministry of Finance explains, they have been “ affected by the repercussions of the difficulties encountered by economic operators, especially large companies which are major taxpayers.”

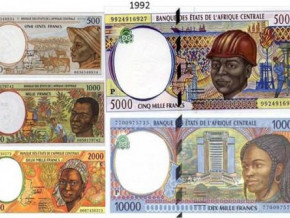

These difficulties may be linked to the non-payment of bills by the State, which has been facing cash flow tensions for several months, but especially to the entry into force of the new exchange regulations in the CEMAC zone in March 2019.

Indeed, the arrival of this new regulation has considerably disrupted international transfers throughout the second and third quarters of 2019, making it difficult for local companies to supply imported raw materials and consumer goods.

Brice R. Mbodiam

Mags frontpage

- Most read 7 days

- shared 1 month

- read 1 month